(seafood.vasep.com.vn) Due to natural conditions, most Middle Eastern countries do not produce agricultural products, including seafood, so there is a great demand for shrimp and catfish products, canned tuna, sardines, mackerel and dried fish.

In the period from 2007 to 2017, Vietnam's total seafood export value to the Middle East market averaged US$300 million per year. Seafood exports to this market reached the highest in 2014 with over US$328 million thanks to the dollar appreciation and reached the lowest in 2007 with US$78 million. From 2007 to 2012, seafood exports to this market continued to grow. From 2013 to 2017, exports to this market fluctuated.

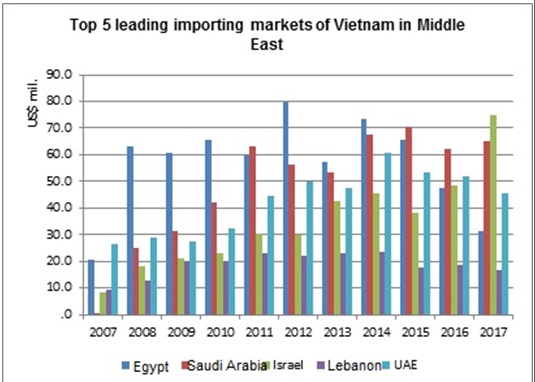

In 2017, the top 5 biggest seafood importers of Vietnam in the region included Israel (US$75 million), Saudi Arabia (US$65 million), UAE (US$45.5 million), Egypt (US$31.4 million) and Iraq (US$10 million).

Fisheries products are consistently put in the top 5 export items of Vietnam in the Middle East. Seafood products for exports to this market mainly included pangasius, shrimp and some canned marine products such as tuna, sardine, mackerel and some other dried fish. Vietnamese pangasius has had a foothold and created trust for consumers in the region.

Pangasius, shrimp, tuna are the main seafood export to the Middle East market in which pangasius accounts for the highest proportion. In 2017, pangasius exports took up 30% and tuna exports accounted for 18% of the total seafood exports to the Middle East.

From 2007 to 2017, the proportion of pangasius decreased from 73% to 47%, the proportion of shrimp increased from 11% to 18% and the proportion of tuna increased from 9% to 30%. The proportion of pangasius exported to this market tends to decrease while that of tuna is increasing; the proportion of shrimp increased from 2007 to 2015, but from 2016 to now it tends to decrease.

Saudi Arabia is Vietnam's largest pangasius buyer in the Middle East

Pangasius always accounts for the highest proportion of fisheries products exported to the Middle East with an average share of about 60% from 2007 to 2017. From 2007 to 2017, Vietnam mainly exported frozen pangasius fillets (HS code 0304) to the Middle East, while exports of processed pangasius (HS code 16) still accounted for a very small proportion.

Saudi Arabia, Egypt and the UAE are the three biggest importers of Vietnamese pangasius, of which Saudi Arabia had the lowest starting point but fastest growth rate in the area.

According to ITC statistics, Vietnam is the largest and only supplier of pangasius to Saudi Arabia. Imports of this item into the country recorded the good growth. In 2016, pangasius imports made up the largest share of Saudi Arabia’s whitefish imports, followed by tilapia meat (HS code 030493); frozen tilapia (HS code 030323), fresh/chilled tilapia (HS code 030271). In addition, this market also imports some other whitefish products such as fresh/chilled hake (HS code 030254), frozen cod (HS code 030363) and Alaska pollock meat (HS code 030494).

In 2016, Vietnam was the largest supplier of whitefish to Saudi Arabia, accounting for 43% of total imports, followed by Myanmar, Egypt, Taiwan, Bangladesh and Thailand.

Due to difficulties, technical barriers to trade in large markets such as the U.S and the EU, many exporters have shifted to other markets such as Americas, Asia and Saudi Arabia.

The Middle East prefers canned tuna

Middle East is currently the best choice for canned tuna exporters in the context of canned tuna consumption in traditional markets such as the U.S and the EU stayed stagnant. Demand in the Middle East has been steadily increasing over the past few years thanks to the continuous growth of food imports from agriculture into the region, particularly among GCC members, including Saudi Arabia, Qatar, Kuwait, Bahrain, Oman and the UAE.

Middle East consumes an average of 200,000 MT of canned tuna each year. Top leading consumers in the region included Egypt, Saudi Arabia and Israel. Thailand is the biggest supplier of tuna to the Middle Eastern markets. However, because of an increase in tuna prices in Bangkok, the Middle East countries tend to look for other alternative markets while the demand for canned tuna in this market is increasing.

In the context of seafood exports to traditional markets such as Europe and South America to decrease, the Middle East is one of the potential markets for seafood exporters of Vietnam in the coming time.

Soure: Vasep